In today's competitive real estate market, savvy investors are discovering a powerful opportunity that many overlook: rooming houses. These properties offer exceptional cash flow potential, consistent returns, and a unique position in the affordable housing sector that continues to grow in demand.

What Makes Rooming Houses Different?

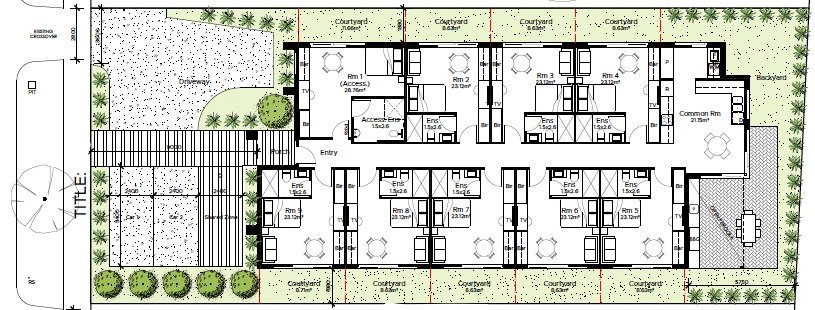

A rooming house, also known as a boarding house, represents a fundamentally different investment proposition compared to traditional residential properties. Rather than leasing an entire property to one tenant or family, rooming houses provide individual rooms to multiple occupants who typically share common facilities such as kitchens, bathrooms, and living areas.

This model creates a unique value proposition:

- Multiple income streams from a single property - reducing vacancy risk and maximizing revenue potential

- Higher rental yields compared to traditional residential properties

- Strong and growing demand in the affordable housing sector

- Portfolio diversification with a proven asset class

The Financial Advantage: Cash Flow That Stacks Up

The numbers tell a compelling story. Traditional residential investment properties typically deliver gross rental yields between 3-5% in major Australian markets. Rooming houses, by contrast, consistently achieve yields of 8-12% or higher, with some premium locations delivering even stronger returns.

Real-World Example

Consider a property valued at $800,000 in a growth corridor suburb. As a traditional single-family rental, it might generate $550 per week ($28,600 annually) - a 3.6% gross yield.

The same property, converted and operated as a rooming house with 6 bedrooms at $220 per room per week, generates $1,320 weekly ($68,640 annually) - an 8.6% gross yield. That's nearly 2.4 times the income from the same asset.

Market Dynamics: Meeting Critical Housing Needs

Australia faces a significant shortage of affordable housing options, particularly in metropolitan areas. Rental vacancy rates remain at historic lows, while housing costs continue to rise faster than wage growth. This creates perfect market conditions for rooming house investments.

Key demographic trends driving demand include:

- Young professionals and students seeking affordable accommodation near employment and education hubs

- Skilled migrants and temporary residents requiring flexible, furnished housing solutions

- Essential workers needing cost-effective options in expensive urban markets

- Individuals in transition between permanent housing arrangements

Location Strategy: Where Rooming Houses Thrive

Success in rooming house investment hinges on strategic location selection. The most profitable properties share common characteristics:

Proximity to Essential Infrastructure

Properties within walking distance or short commutes to major employment centers, universities, hospitals, and public transportation networks command premium rents and maintain high occupancy rates year-round.

Growth Corridor Positioning

Areas experiencing infrastructure investment, employment growth, and population increase offer both strong immediate returns and long-term capital appreciation potential.

Regulatory Environment

Understanding local council regulations regarding rooming house operations is critical. Properties in municipalities with clear, manageable regulatory frameworks provide more stable investment environments.

"Location isn't just about where the property sits - it's about positioning yourself at the intersection of demand, infrastructure, and opportunity."

Operational Excellence: Maximizing Your Investment

Unlike traditional buy-and-hold residential investments, rooming houses require active management to achieve optimal returns. However, this operational component also provides opportunities to add value and differentiate your offering.

Professional Property Management

Successful rooming house investors either develop in-house management capabilities or partner with specialized property managers who understand the unique requirements of multi-tenant operations, including:

- Tenant screening and selection processes

- Common area maintenance and cleaning schedules

- Conflict resolution and community management

- Compliance with safety and regulatory requirements

Value-Add Opportunities

Strategic improvements can significantly boost rental income and occupancy rates:

- Room configuration optimization to maximize rentable space while maintaining comfort

- Modern furnishings and amenities that appeal to quality-conscious tenants

- Technology integration including smart locks, security systems, and high-speed internet

- Common area enhancement creating attractive, functional shared spaces

Quality finishes and thoughtful design command premium rents while reducing vacancy periods

Risk Management and Mitigation

Every investment carries risks, and rooming houses are no exception. However, understanding and actively managing these risks significantly improves investment outcomes.

Vacancy Risk Distribution

One of the key advantages of rooming houses is the natural diversification across multiple tenants. When a traditional rental property loses its tenant, income drops to zero. With a 6-bedroom rooming house, losing one tenant reduces income by approximately 17%, with remaining income continuing to cover expenses while you find a replacement.

Regulatory Compliance

Rooming houses operate under specific regulations that vary by location. Successful investors:

- Thoroughly research local requirements before acquisition

- Maintain proper registration and licensing

- Ensure properties meet all safety standards

- Stay informed about regulatory changes

- Build positive relationships with local authorities

Maintenance and Repair Considerations

Higher occupancy means increased wear and tear. Budget appropriately for:

- Regular preventive maintenance schedules

- Rapid response to repair issues

- Periodic refurbishment of high-use areas

- Reserve funds for unexpected expenses

Financing Your Rooming House Investment

While rooming houses offer superior returns, financing can require specialized approaches. Traditional lenders may have different criteria or require higher deposits for commercial or semi-commercial properties.

Financing Strategies

Experienced rooming house investors employ several approaches:

- Specialist lenders who understand rooming house business models and evaluate applications based on projected income

- Staged conversion financing where properties are initially purchased as residential before conversion

- Portfolio leverage using equity from existing properties

- Joint venture partnerships combining capital and expertise

"The right financing structure can be the difference between a good rooming house investment and an exceptional one. Don't settle for the first offer - explore all options."

Tax Considerations and Benefits

Rooming house investments offer several tax advantages that enhance overall returns:

- Depreciation deductions on building, fixtures, and furnishings

- Operating expense deductions including management, maintenance, and utilities

- Interest deductions on investment property loans

- Capital works deductions for structural improvements and renovations

Note: Tax situations vary by individual circumstances. Always consult with a qualified tax professional or accountant to understand implications for your specific situation.

The Future of Rooming House Investment

Several macro trends suggest rooming houses will remain attractive investments for the foreseeable future:

Ongoing Housing Affordability Challenges

As property prices and rents continue rising faster than incomes, demand for affordable housing alternatives will remain strong. Rooming houses provide an essential middle ground between homelessness services and traditional rental accommodation.

Changing Living Preferences

Younger generations increasingly prioritize flexibility and affordability over homeownership. This cultural shift supports sustained demand for alternative housing models including rooming houses.

Government and Institutional Recognition

Growing recognition of rooming houses as a legitimate component of the housing ecosystem is leading to more supportive regulatory environments and potential incentive programs in some jurisdictions.

Getting Started: Your Rooming House Journey

For investors considering rooming houses, success begins with thorough preparation:

Education and Research

Understand the local market, regulatory requirements, and operational demands before committing capital.

Build Your Team

Assemble experts including experienced property managers, accountants familiar with rooming house structures, and solicitors who understand relevant regulations.

Analyze Opportunities

Develop clear criteria for evaluating potential properties, focusing on location fundamentals, property condition, and income potential.

Start with Systems

Establish operational systems before acquisition to ensure smooth management from day one.

Plan for Scale

Consider how your first property fits into a broader portfolio strategy. Systems that work for one property can scale to multiple assets.

Conclusion: Stacking Your Advantage

Rooming houses represent a compelling opportunity for investors seeking strong cash flow, portfolio diversification, and participation in addressing critical housing needs. While they require more active management than traditional residential investments, the superior returns and risk distribution make them an attractive addition to a well-structured property portfolio.

The key to success lies in thorough due diligence, strategic property selection, operational excellence, and ongoing adaptation to market conditions. For investors willing to look beyond conventional approaches, rooming houses offer a proven path to building sustainable wealth through real estate.

Ready to Explore Rooming House Opportunities?

StackOn Ventures specializes in identifying, acquiring, and developing high-performing rooming house investments across Australia. Our team brings decades of combined experience in property development, operations management, and investment structuring.

Schedule a Strategy Call